The Importance of Elliott Wave Theory in Forex

Elliott Wave Theory is a technical analysis concept established by Ralph Nelson Elliott in the early 1930s that traders use to examine and quantify price patterns in financial markets by looking at cycles. According to the idea, changes in investor attitude and psychology produce impulse waves and corrective waves within bigger market price movements.

Elliott wanted something to do with his time after being forced into retirement due to sickness, so he began studying 75 years of annual, monthly, weekly, daily, and self-made hourly and 30-minute charts across numerous indices. He thought that market prices follow certain wave patterns, which his followers refer to as 'Elliott waves.' In his book 'The Wave Principle,' he proposed this market behavior hypothesis in 1938. In his final work, 'Nature's Laws: The Elliott Wave Principles,' published in 1946, he presented his Elliott Wave Principles in detail. The Secret of the Universe’

The idea tries to predict market trends by finding the greatest extremes in trader psychology that cause price action's highs and lows.

Elliott wave experts think that each wave has its own personality, which is generally a reflection of the present market's psyche. The key to correctly using the Elliott Wave Principle is regarded to be understanding the characteristic.

The following Elliott Wave definitions are based on a bullish stock market; in bad markets, the characteristics are reversed.

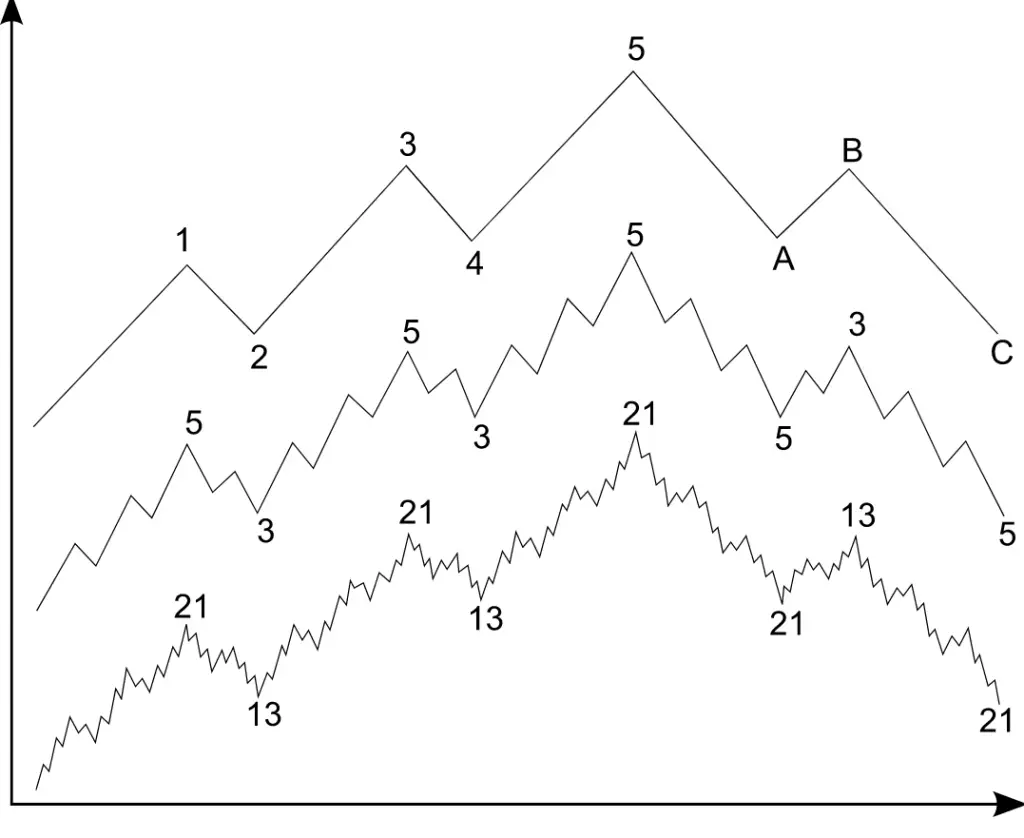

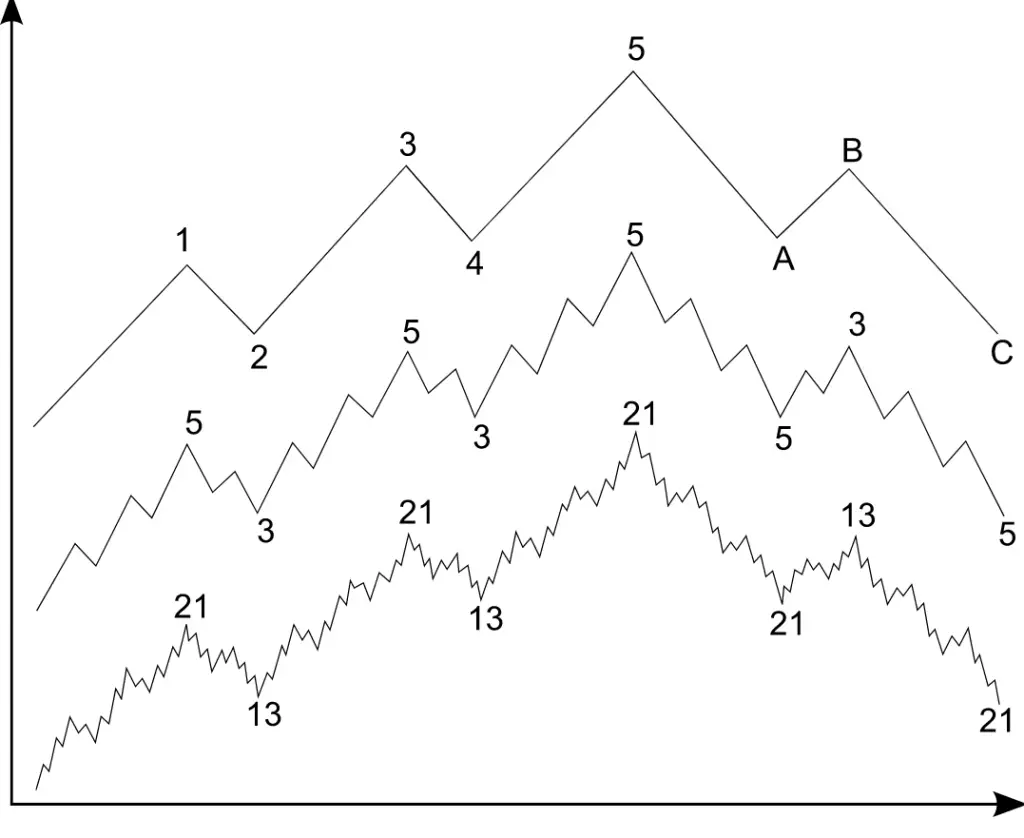

The five wave pattern inside the dominant market trend.

Wave 1: Wave one isn't always evident when it starts. The fundamental news is nearly uniformly bad when the first wave of a new bull market begins. The prior trend is still seen to be quite robust. Fundamental experts continue to decrease their profit projections, implying that the economy is not doing well. Put options are popular, and implied volatility in the options market is strong. Sentiment polls are extremely gloomy. As prices climb, volume may increase slightly, but not enough to alarm many technical experts.

Wave 2: Wave two corrects wave one, but it can never extend beyond wave one's start point. The news is usually still poor. As prices retest the previous bottom, gloomy sentiment grows, and "the mob" haughtily reminds everyone that the bear market is still very much alive. Still, for those who are looking, some good indications emerge: volume should be lower during wave two than wave one, prices should not retrace more than 61.8 percent of wave 1 gains, and prices should fall in a three-wave pattern.

Wave 3: Although some data says that wave five is the strongest in commodities markets, wave three is frequently the largest and most powerful wave in a trend. Now that the news is good, fundamental experts are starting to improve their earnings projections. Prices grow swiftly, with only brief and shallow corrections. Anyone hoping to 'catch a downturn' will almost certainly miss the boat. The news is probably still gloomy when wave 3 begins, and most market participants are still bearish; but, by wave 3's midpoint, 'the crowd' will frequently join the new optimistic trend. Wave 3 frequently outnumbers wave 1 by a factor of 1.618:1.

Wave 4:Wave four is usually a clear corrective wave. Wave four often retraces less than 38.2 percent of wave 3 and may wander sideways for a long time. The volume is significantly lower than that of wave 3. If you understand the potential for wave 5, this is a fantastic location to purchase a pullback. Despite this, 4th waves might be irritating due to their lack of advancement in the overall trend.

Wave 5: Wave five is the final leg in the dominating trend's direction. Almost all of the news is favorable, and everyone is optimistic. Regrettably, this is when many typical investors eventually buy in, just as the market is peaking. In wave 5, volume is often lower than in wave 3, and several momentum indicators begin to exhibit divergences; prices achieve a new high, but the indicators do not. Bears may be mocked at the end of a strong bull market; remember how projections for a stock market high in 2000, 2007, and 2020 were all dismissed.

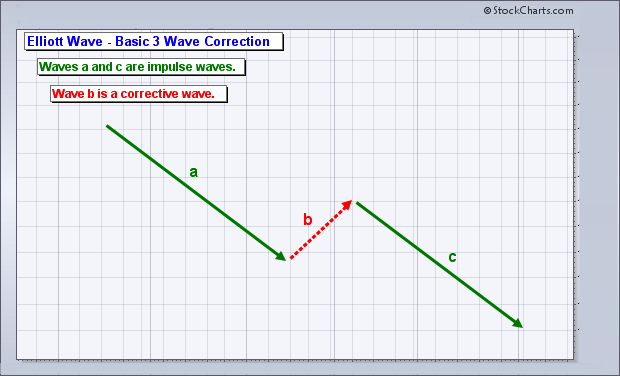

Three wave pattern the corrective trend.

Wave A: Corrections can be more difficult to spot than impetuous moves. Fundamental news is typically still encouraging during wave A of a bear market. The decrease is seen as a correction inside an ongoing bull market, according to most experts. Increased volume, growing implied volatility in option markets, and maybe a move upward in open interest in associated futures markets are some of the technical indications that precede wave A.

Wave B: Many expect a return of the now-defunct bull market as prices reverse higher. The peak may be seen as the right shoulder of a head and shoulders reversal pattern by those versed with conventional technical analysis. During wave B, the loudness should be lower than during wave A. Fundamentals are most certainly no longer improving at this time, but they haven't yet turned negative.

Wave C: In five waves, prices fall impulsively. By the third leg of wave C, practically everyone has realized that a bear market has established itself. Wave C is usually at least as big as wave A, and it can go up to 1.618 times the size of wave A.

Elliott Waves Basics

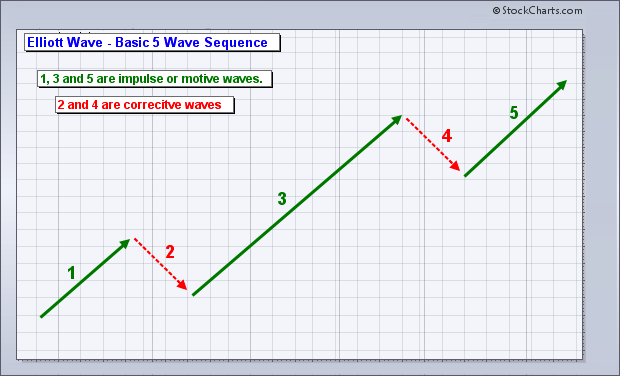

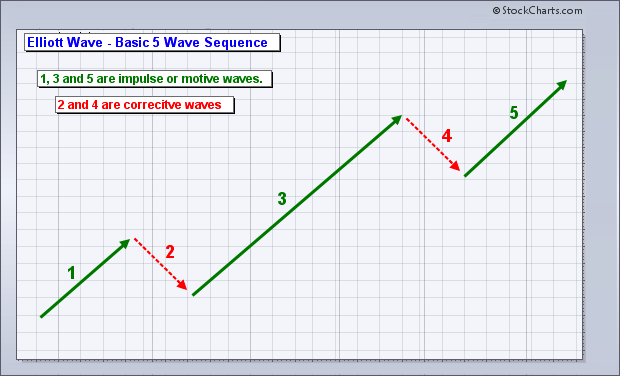

A move in the trend's direction is called "impulsive," and it will take 5 waves to complete in the principal direction. A counter-trend move is referred to as a "corrective" move because it consists of three waves that run in the opposite direction of the dominant trend.

Even within the impulsive 5-wave move, waves 1, 3, and 5 will move in the major trend's direction, while waves 2 and 4 will move in the opposite way.

Elliott wave rules and guidelines:

A correct Elliott wave count must observe three rules:

- Wave 2 never retraces more than 100% of wave 1.

- Wave 3 cannot be the shortest of the three impulse waves, namely waves 1, 3 and 5.

- Wave 4 does not overlap with the price territory of wave 1, except in the rare case of a diagonal triangle formation.

Waves 2 and 4 in a five-wave pattern typically adopt opposite shapes, according to a popular rule known as 'alternation,' which states that a simple sharp move in wave 2 indicates a complicated moderate move in wave 4. Zigzags, flats, and triangles are all examples of corrective wave patterns. These corrective patterns can then be used to create more complicated repairs. A triangular corrective pattern, on the other hand, is generated most often in wave 4, but extremely rarely in wave 2, and indicates the conclusion of a correction.

No comments