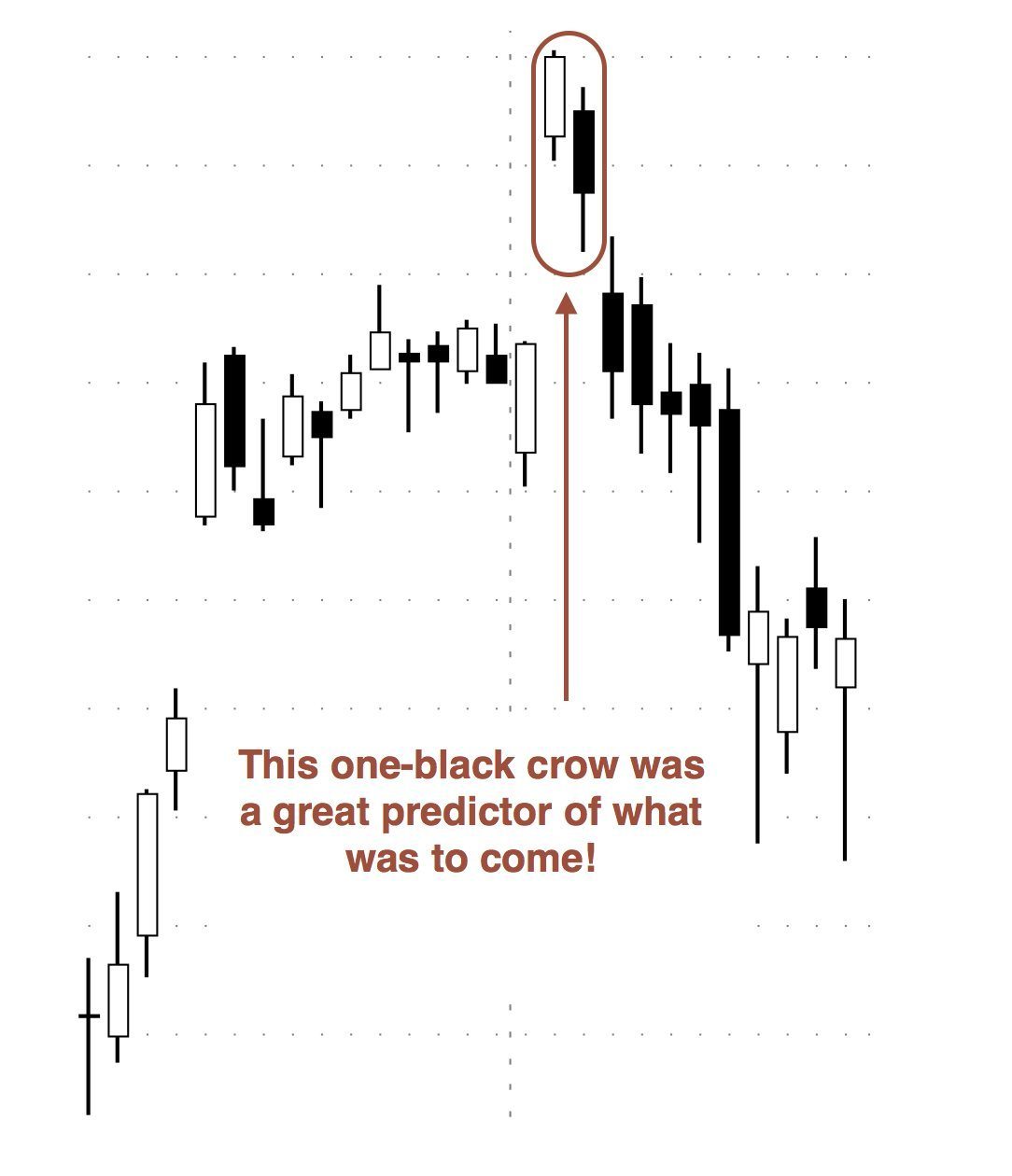

The bearish black crow: meaning, and trading strategy

The bearish black crow is a two-candle bearish reversal candlestick pattern that emerges in a positive trend. The first is bullish, while the second is bearish, with the red candlestick opening lower than the previous close and closing lower than its open. The design resembles the Bearish Harami pattern in appearance. The only difference is that the second period closes lower, preventing the red body from being engulfed by the green body before it. If the price cannot finish above the previous week's close, there is a greater likelihood that it will fall.

Recognition Criteria

The first candle is long and bullish, continuing an uptrend; the second candle is long and bearish, opening inside the body boundaries of the first candle and closing below the open of the first candle.

What Does a One Black Crow Mean?

The market is in a positive trend when the first positive candle appears, indicating that market sentiment is generally optimistic. Market participants anticipate that prices will continue to rise and, as a result, they elect to be long the market.

However, after a long period of upward movement, investors begin to fear that the bullish trend is coming to an end.

As a result, some traders opt to exit their long positions, resulting in a torrent of sell orders flooding the market. As a result, the market drops and opens below the previous candle's open.

As more individuals become aware of the disparity, they begin to dread the same thing, adding to the selling pressure, causing the market to fall even more.

As the preceding bar's open, which is a big resistance level, fails to hold, more market players understand there isn't enough strength in the market to keep the trend going. This increases the selling pressure and makes it more likely that the negative trend will continue.

Way to improve the Bearish One Black Crow

While some traders claim that candlestick patterns may be traded as is, this is rarely the case. Most candlestick patterns aren't precise enough to be deemed tradeable by most individuals, and therefore require extra filters and criteria in order to be worthwhile.

We wanted to offer some of our favorite strategies of screening out poor trades in this section of the post, which we've had a lot of success with in the past.

Just keep in mind that what works depends a lot on the industry and timing you pick. As a result, we always recommend backtesting anything before going live to confirm that it works for you.

Now that it's out of the way, let's get started!

Seasonality

Seasonality is something that a lot of traders neglect. That's unfortunate, because it has so much promise!

In a nutshell, seasonality suggests that markets are more likely to be bullish or bearish at specific periods on a regular basis. Some markets, for example, tend to do better throughout specific months of the year.

However, on weekdays, where we've had a lot of success, we prefer to use seasonal characteristics. Many markets, for example, have days when they are more bullish or bearish. And, if you're aware of these patterns ahead of time, you may utilize them to better timing your entry!

Oversold/Overbought readings

When it comes to reversal patterns like the bearish one crow, the amount a market has moved up before creating the pattern might be crucial. Before we can search for reversal indications, we simply need to have a trend to begin with.

You may look at the distance of the close to the 200-period moving average as a specific strategy for this. If the gap is large, it indicates that the market is in a strong trend that will, in principle, soon reverse.

No comments